The Defense Brief: March 2025

March kicked off with major moves in Europe: Germany passed a historic $1 trillion boost to defense spending, and Sweden committed to raising its defense budget to 3.5% of GDP. Meanwhile, the EU unveiled its first-ever defense industrial strategy, aiming for member states to spend 50% of their defense procurement budgets on domestically made products.

That’s a stark shift from the current reality — 2/3 of EU arms imports come from the US. Despite the war in Ukraine, EU dependency on foreign defense suppliers has only grown since 2020 and our arms imports have doubled over this period.

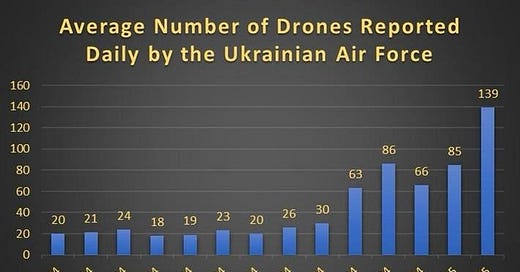

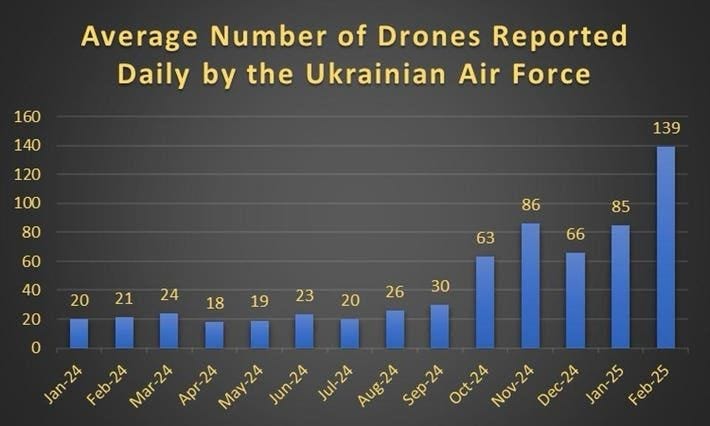

Still, there’s reason for optimism: the US remains the world’s top arms exporter, but France and Germany are now 2nd and 5th respectively, showing potential for the EU to scale its own capabilities. The question is: how fast can we scale? In February alone, Russia launched as many Shahed drones as the US Replicator Initiative aims to deliver by 2027.

Meanwhile, Helsing, Europe’s most valuable defense tech startup, is facing criticism — both from the battlefield and the boardroom. Its newly deployed drones drew mixed feedback, and its partnership with Rheinmetall fell through. It’s a reminder that new entrants in defense often meet resistance from entrenched players — and that Europe’s race to build modern defense primes is still in its early-stage.

In contrast, China continues to showcase new unmanned systems — from FPV drones to robot dogs.

It’s no surprise then that both Japan and South Korea are also accelerating, with local primes now among the fastest-growing defense companies globally, outpacing their US and EU counterparts.

Over in Taiwan, the Endeavor Manta made its debut — the country’s first unmanned surface vessel for surveillance and combat. Low-cost unmanned boats are proliferating worldwide, and Saronic’s massive round is just one signal of the trend.

Fundraising Highlights

Shield AI raised $240m at a $5.3B valuation from L3Harris. Unlike Anduril’s multi-domain approach, Shield AI has stayed laser-focused on autonomy software.

Advanced Manufacturing Company of America raised $76m from Caffeinated and Lux to acquire and modernize legacy defense supply chains.

Allen Control Systems raised a $30m Series A from Craft to build autonomous weapon stations for counter-drone operations.

Frankenburg Technologies raised €4m from Blossom Capital to develop affordable air defense missiles — Blossom’s first defense investment.

Polar Mist emerged from stealth to pursue European maritime dominance, with backing from Air Street and 201 Ventures.

Alpine Eagle raised a €10m seed round led by IQ Capital, with General Catalyst and HCVC, to build cost-effective airborne counter-drone systems.