The Defense Brief: April 2025

The month opened with a striking signal: Palantir secured a landmark NATO contract for its Maven Smart System, an AI-powered platform designed to prioritize battlefield targets. Two things stand out:

1/ NATO described it as “one of the most expeditious” procurements in its history—delivered in just six months—indicating that acquisition cycles are finally catching up to wartime demands.

2/ Despite talk of Europe reducing its dependence on U.S. contractors, pragmatism prevails. With no credible domestic alternatives, defense ministries continue to buy American.

On the battlefield, the character of war is evolving rapidly. Ukraine’s ambassador to the UK, Valerii Zaluzhnyi, captured the shift: drones and digital systems are reshaping combat; armor is increasingly vulnerable; electronic warfare is undermining precision weapons; and naval domains are now contested by autonomous drones. Rethinking doctrine, procurement, and strategy isn’t optional—it’s overdue.

Just today, in Washington, a proposed $150 billion increase would push the U.S. defense budget north of $1 trillion, funneling tens of billions into shipbuilding, munitions, and the Trump-era “Golden Dome” missile shield initiative.

Startups are responding to the moment. Shield AI unveiled an upgraded V-BAT drone, showing what the future of intelligence, surveillance and reconnaissance (ISR) will look like: long-endurance, AI-enabled, and operationally flexible. Firestorm Labs, meanwhile, landed a $100 million IDIQ contract from the U.S. Air Force. Hypersonics also saw a milestone: Venus Aerospace successfully tested a novel nozzle for its rocket engine, bringing affordable hypersonic flights closer to reality.

Yet vulnerabilities persist. A Forbes investigation revealed that even Pentagon-backed drone startups rely heavily on Chinese manufacturing—a critical supply chain weakness echoed in Europe. Basically, DJI still dominates the landscape and it is hard to find Western manufacturers for every component required in a drone. The Pentagon’s “Blue List,” which clears drones for military use, illustrates the gap: only 23 out of over 300 applicants were approved. For the West, achieving true autonomy means rebuilding domestic supply chains—component by component.

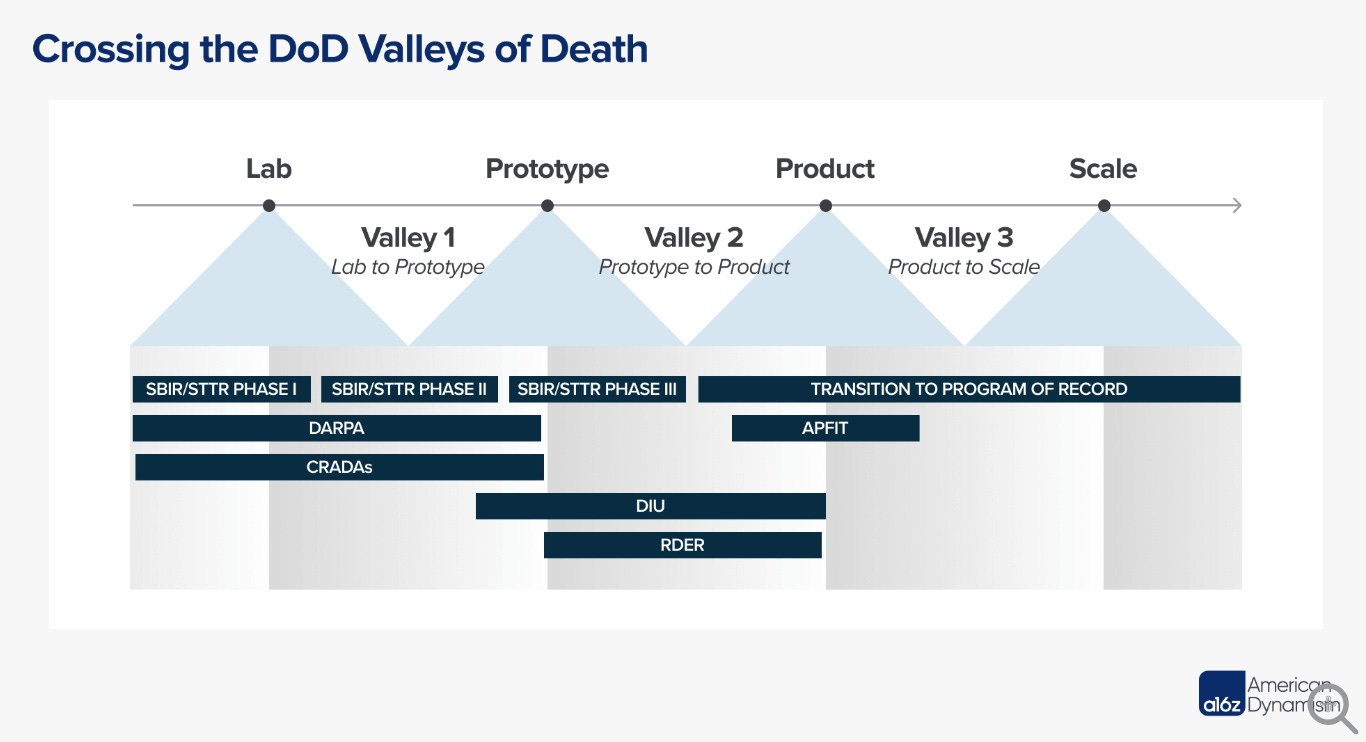

For startups navigating U.S. defense contracting, a16z released a useful primer explaining key pathways like SBIR, OTA, and FAR. It’s a clear reminder that the U.S. military is not a monolith but a patchwork of stakeholders and processes.

Looking East remains essential for reading the future. China’s Norinco, their largest arm manufacturer, revealed the “Bullet Curtain,” a cheap, AI-guided anti-drone barrage weapon system. Taiwan is preparing to trial its first fleet of indigenous autonomous boats this June—another step toward a more distributed, drone-dominated maritime domain.

Major Fundraising News

Eric Slesinger unveiled 201 Ventures, a $22M debut fund, to focus on backing European defense companies.

ARX Robotics raised €31M in a Series A led by HV Capital. The German startup is building modular unmanned ground systems and AI-powered operating software to modernize European land forces.

Aetherflux announced a $50M Series A from Index Ventures, targeting defense as an early market for its off-grid energy systems designed for forward operating bases.

Theseus AI raised $4.3M in seed funding from First Round Capital. The startup—building GPS-denied navigation systems for drones using computer vision—emerged from Y Combinator and has early traction with U.S. Special Forces.